Central Bank of Iraq Launches Project for Nation's First Virtual Bank

The Central Bank of Iraq (CBI) has announced the initiation of the project for the country's first virtual bank, marking a significant step towards digital transformation in the financial sector. This move aims to leverage advanced technology to enhance services, boost financial inclusion, and modernize banking operations.

Project Details

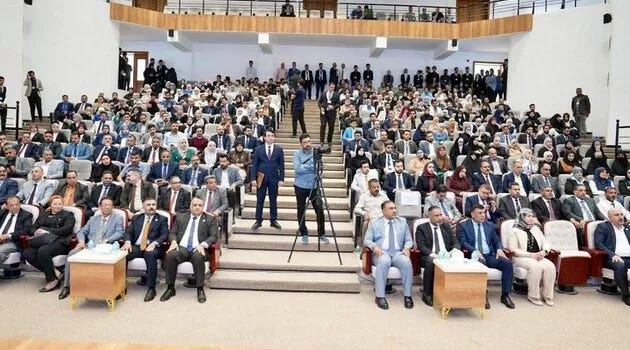

The announcement was made by the Governor of the Central Bank of Iraq, Ali Mohsen Ismail Al-Allaq, signifying the official start of the project to establish Iraq's inaugural virtual bank. This initiative is positioned as a cornerstone in the broader effort to develop and upgrade the nation's banking infrastructure.

The virtual bank is intended to operate entirely remotely, eliminating the need for physical branches. It will utilize advanced technologies to provide a wide array of banking services directly to customers.

Goals and Benefits

The primary objectives behind launching the virtual bank project include:

Enhancing digital financial services: Providing convenient, technology-driven banking solutions.

Facilitating transactions: Making financial transactions easier and more accessible for individuals and businesses.

Expanding financial inclusion: Reaching underserved populations and bringing them into the formal financial system.

Reducing costs: Lowering operational costs for banks and transactional costs for customers.

Attracting investment: Signaling a commitment to modernization that can appeal to domestic and international investors.

The CBI emphasized that the virtual bank will prioritize security and reliability to build trust among users.

Implementation and Future Steps

The launch of this project represents the crucial first step in building a comprehensive virtual banking system within Iraq. While this initial phase focuses on the groundwork for the first virtual bank, the Central Bank is also encouraging other commercial banks in the country to explore and implement their own digital transformation initiatives. This suggests a potential shift towards a more digitally-centric banking landscape across Iraq in the coming years.

Looking Ahead

The successful implementation of Iraq's first virtual bank holds significant promise for the country's financial future. It could pave the way for increased competition, innovation in financial products, and greater access to banking services for a wider population. For founders and professionals in the MENA region, this development highlights the accelerating pace of digital transformation within the Iraqi market and potential opportunities in the fintech space.

Source: Iraq Business News